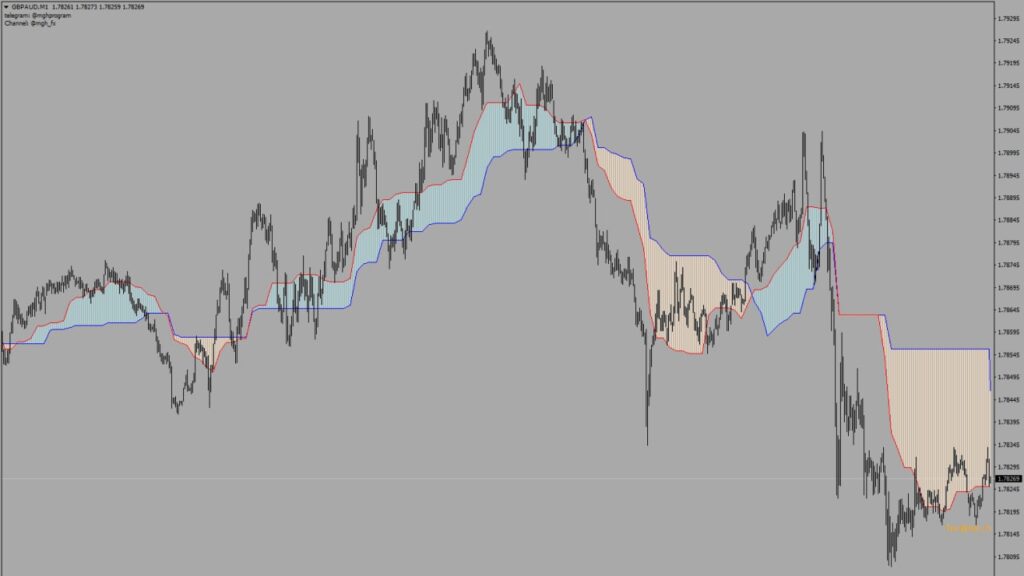

This version is based on 52 Kigunsen, candlestick and price action principles. It can be a valuable asset When looking for an entry point and a strong trend representation.

Pass: www.mghfx.com

Instruction:

When the price closes above the blue trigger, we open a position to touch the first and second targets of the system while placing a stop loss.

Candle stop strategy :

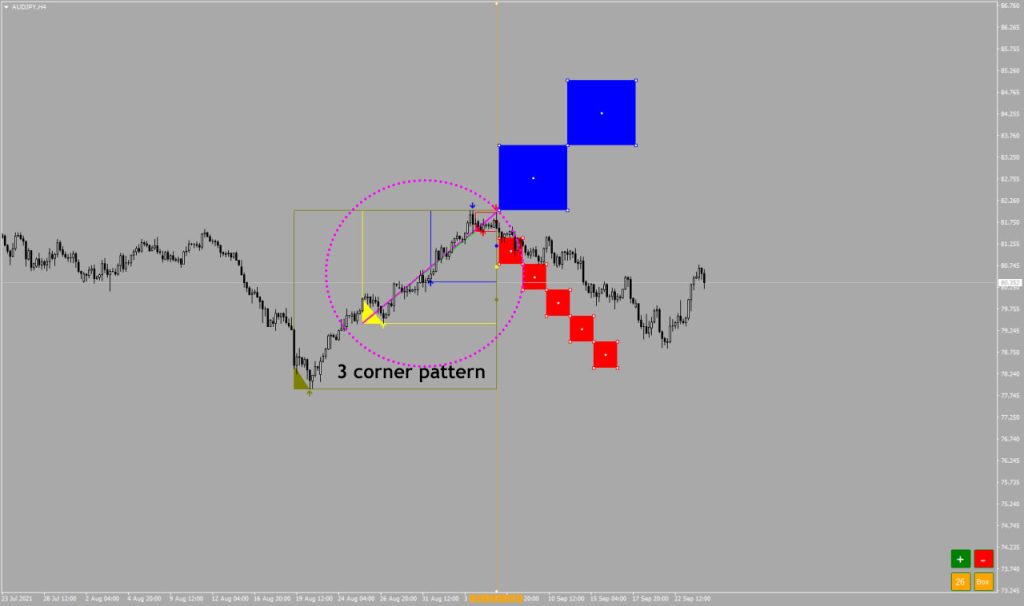

To use this strategy, you need a candlestick chart or a 52-period Kijunsen line without shift.

The Candle Stop Strategy involves buying above the Kijun-sen 52 and selling below it.

To identify the entry candle signal on the chart, follow these guidelines:

- For a buy entry candle, look for a candle that has closed above 75% of its range and must be closed above the Kijun-sen 52.

- For a sell entry candle, search for a candle that has closed below 75% of its range and must be closed below the Kijun-sen 52.

- When buying, the entry candle’s low price or the previous candle’s low price must be lower than the low price of the previous five candles.

- When selling, the entry candle’s high price or the previous candle’s high price must be higher than the high price of the previous five candles.

- In the buying mode, we place a buy stop order a few pips (equal to the size of the spread) above the high of the candlestick pattern and a few pips (also equal to the size of the spread) below the low of the pattern.

- In selling mode, we place a sell stop order a few pips (equal to the size of the spread) below the level of the candlestick stop and a few pips (also equal to the size of the spread) above the stop loss.

- To manage capital effectively, we place two take-profit (TP) orders in each transaction with equal amounts: the first TP is placed at the distance from the entry point to the stop-loss point, and the second TP is twice the size of the first.

- If the last candlestick forms a pattern in the same direction as the trade, it indicates a stronger trading opportunity

- However, it’s important to note that the entry candle should not be a big emotional candle or a news candle.

It is recommended to use this method in time frames above 4 hours.

Parameters:

- Draw the second to fourth TPs as desired.

- Protect trades with stop loss and take profit.

- Color the chart according to the user’s preference.

- Filter weak signals using the settings menu.

- Identify the news signal candle.

- Do not display past signals to avoid clutter on the chart.

- Show the high and low visibility of the entry candle with a dash.

- Determine the stop location using ATR.

- Allow users to set the close percentage (default is 75%).

- These parameters can be adjusted through the entry menu.

- Users can choose between Mowing or Kigensen lines type.

- Adjust moving or kijun parameters such as time period, line shift and….

- Users can also change the percentage of closes in the range, located in the final candle.