Pass: www.mghfx.com

Strategies :

- TimeEnding appropriate for scalp forex strategy

- Candlesticks are suitable for time frames that are more than one hour.

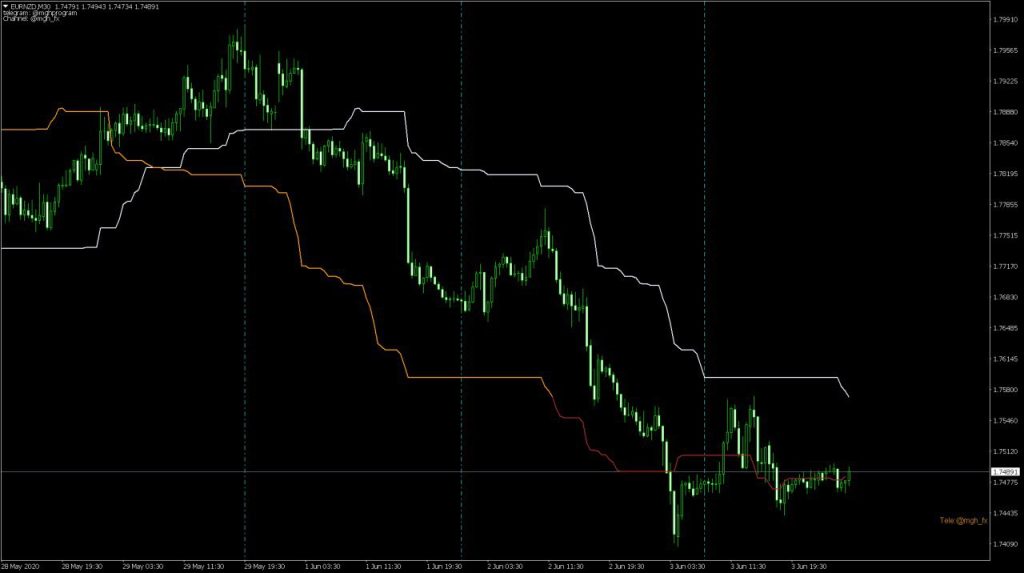

Time ending strategy :

The success rate of this strategy is more than 70%.

For a buy position in a 5-minute chart, the entry candle must meet the following conditions:

- The current candle must close positively within an hour.

- At the same time as condition (1), the current candle must close positively within 30 minutes.

- At the same time as condition (1), the current candle must close positively within 15 minutes.

- At the same time as condition (1), the current candle must close positively within 5 minutes.

After meeting the above conditions and implementing capital management, we place a stop signal at 3 pips above the one-hour close candle. If the stop order is not activated within 15 minutes, we will delete the pending order.

For greater certainty, using a direct order instead of a pending order can be considered.

To buy directly, we need to see a close on the entry trigger within the next three candles in the 5-minute period.

The stop position can be set 3 pips below the one-hour candle.

The target should be equal to the distance from the stop to the entry point.

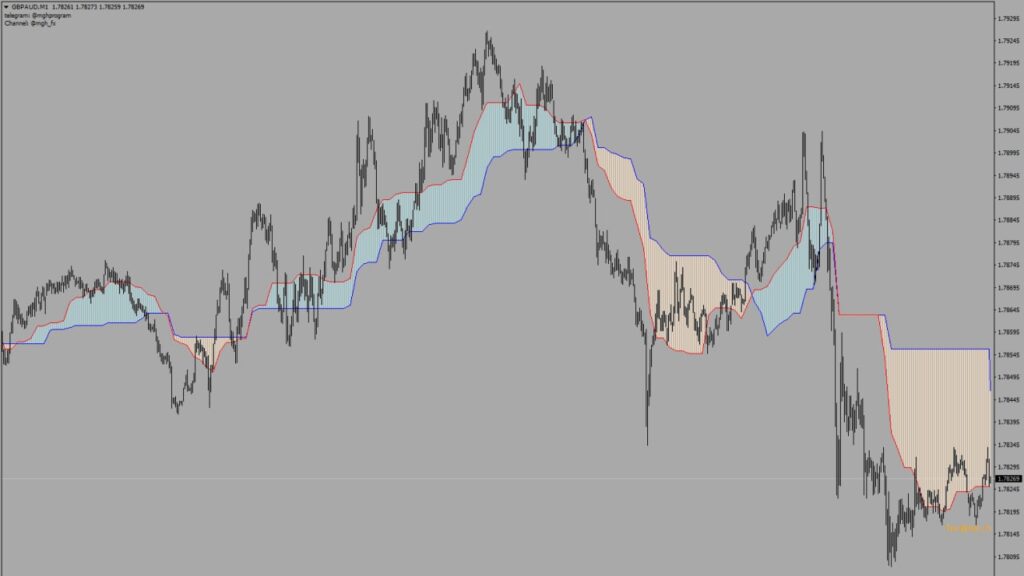

Candlestick strategy :

The necessary approvals are as follows:

- The color of the signal candle must be opposite to that of the previous candle.

- The candle should have at least half its length as shadow, but not exceeding three-fifths (3/5) of the entire length.

- In the buy signal, the volume of the shadow on the upper side should be less than 15% of the total length of the candle.

- The length of the candle should be more than 80% of the ATR of that candle.

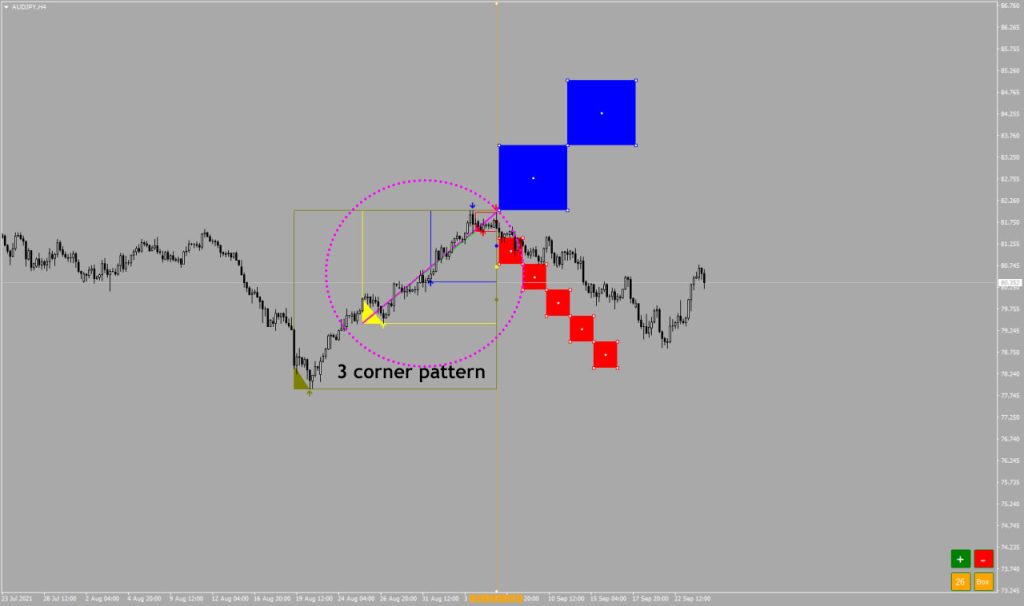

How the indicator works :

As you can see in the picture above, the indicator displays the entry candle with an arrow. To enter a long position, place a stop order on top of that candle at half the length of the signal candle body.

The target is set to the same length as the signal candle, and the stop is placed behind the entry trigger to provide a one-to-one risk to reward ratio. When the price gets close to the target, you can close half of the volume and double the target distance.

If the stop is hit, you can immediately enter a position against the direction of the signal. This is because this candle pattern usually forms in the middle or at the end of a trend.